Thinking of buying a property while living in Indonesia? You’re not alone. Many expatriates fall in love with the lifestyle here vibrant culture, dynamic cities, tropical escapes and start thinking about settling in more permanently. But when it comes to getting a mortgage as a foreigner, the process might feel confusing.

The good news? It’s entirely possible with the right information and support. In this article, we embark on an exploration of the possibilities of an expat mortgage in Indonesia, unlocking the doors to homeownership for those seeking to build their lives in this enchanting nation.

Is it possible for expats to get a mortgage in Indonesia?

Not only Indonesian citizens (WNI) but also foreign citizens (WNA) can now enjoy the property mortgage facility. As is known, the government has enacted regulations regarding permits for foreigners to buy property in Indonesia. Article 186 of Agrarian and Spatial Planning/National Land Agency Regulation Number 18/2021 regulates the limitation of home ownership for foreigners:

For the site house:

Houses with the category of luxury houses in accordance with the provisions of laws and regulations; 1 piece of land per person/family; and/or the land is at most 2,000 m2;

For apartment:

Apartments or flats in the category of commercial space. In the case of providing a positive impact on the economy and society, the site house can be given more than 1 piece of land or an area of more than 2,000 m2, with the permission of the minister in charge of government affairs in the fields of agriculture, land, and spatial planning.

It is stated in the article that foreigners are allowed to have landed houses with status built on state land or private land with the Right to Use (HPL) Certificate. In addition, foreigners are also allowed to own flats or apartments that stand on land with the status of building use rights (HGB). Referring to these regulations, it is certain that not all types of property can be purchased by foreigners, even with ownership rights.

Foreigners are not allowed to own property with a Certificate of Ownership (SHM). In accordance with applicable regulations, property with certificates of ownership may only be owned by Indonesian citizens. Even so, as mentioned above, foreigners can still apply for a property purchase using a mortgage.

However, there is several terms and conditions that must be met when applying for a mortgage for foreigners. In addition, the choice of banks providing mortgage facilities for foreigners is limited. Not all banking institutions in Indonesia serve mortgages for foreigners.

List of Banks Providing KPR Services for Expatriates

As a Foreign National (WNA), you may be interested in owning property in Indonesia. One way you can do this is through a Home Ownership Credit (KPR).

However, it is important to note that KPR for WNA has some differences from KPR for WNI. Here are a few things you need to know:

As a Foreign National (WNA), you may be interested in owning a home in Indonesia. Fortunately, KPR (Kredit Pemilikan Rumah) or Mortgages are available to WNA, allowing you to purchase a house through a credit scheme. However, it’s important to note that there are specific requirements and conditions that WNA must meet when applying for KPR. Additionally, the number of banks offering KPR to WNA is limited.

Here are some banks that provide KPR services for WNA:

Bank Permata Syariah:

Requirements:

- WNA who work and reside in Indonesia for at least 2 years (employees) or 4 years (entrepreneurs)

- Minimum monthly salary of Rp 25 million

- Minimum property price of Rp 2 billion

- Minimum loan amount of Rp 1 billion

- SHGB certificate

- Ready stock property

*This KPR service from Permata Bank is based on Islamic Sharia principles.

J Trust Bank

Requirements:

- Indonesian citizen or WNA domiciled in Indonesia

- Minimum age of 21 years

- Minimum work experience of 2 years

- Minimum experience of 3 years in the same field (professional/entrepreneur)

Advantages: Competitive interest rates, Loan tenor up to 30 years

What are the requirements to apply for a mortgage in Indonesia?

To apply for a mortgage in Indonesia, here are the requirements that all expats must meet:

- All nationalities except all African territory’s citizens

- For employees: min. 2 year working periods (including previous working periods)

- For self-employed: min. 4 years within the industry

- 21-57 years old

- Minimum income IDR 25 million/month

Documents needed:

- Photocopy KITAS/KITAP/KIMS/KTP WNA / Temporary Stay Permit Card, Permanent Stay Permit Card

- Photocopy Passport

- Reference Letter (for employee)

- Photocopy Marriage Certificate

- Photocopy of Prenuptial Agreement (if any)

- Photocopy of Declaration of Name Change (if any)

- Photocopy Taxpayer Identification Number

- Photocopy Last 3 Months Saving Account

- Photocopy Annual Tax Return (if any)

- If the applicant is self-employed, there are some additional requirements that the applicant must submit like notary company act (Akta PT), domicile licence (SKTU) if any, trade licence (SIUP/NIB), etc.

Property Ownership Regulations for Foreigners in Indonesia

Property Types

According to Article 186 of Regulation 18 of 2021, WNA are only allowed to own two types of residential properties:

- Landed houses: Categorized as luxury houses according to regulations, with a limit of one land plot per person/family and a maximum land area of 2,000 square meters.

- Strata-title apartments: WNA can own commercial-category apartments.

Property Price Regulations

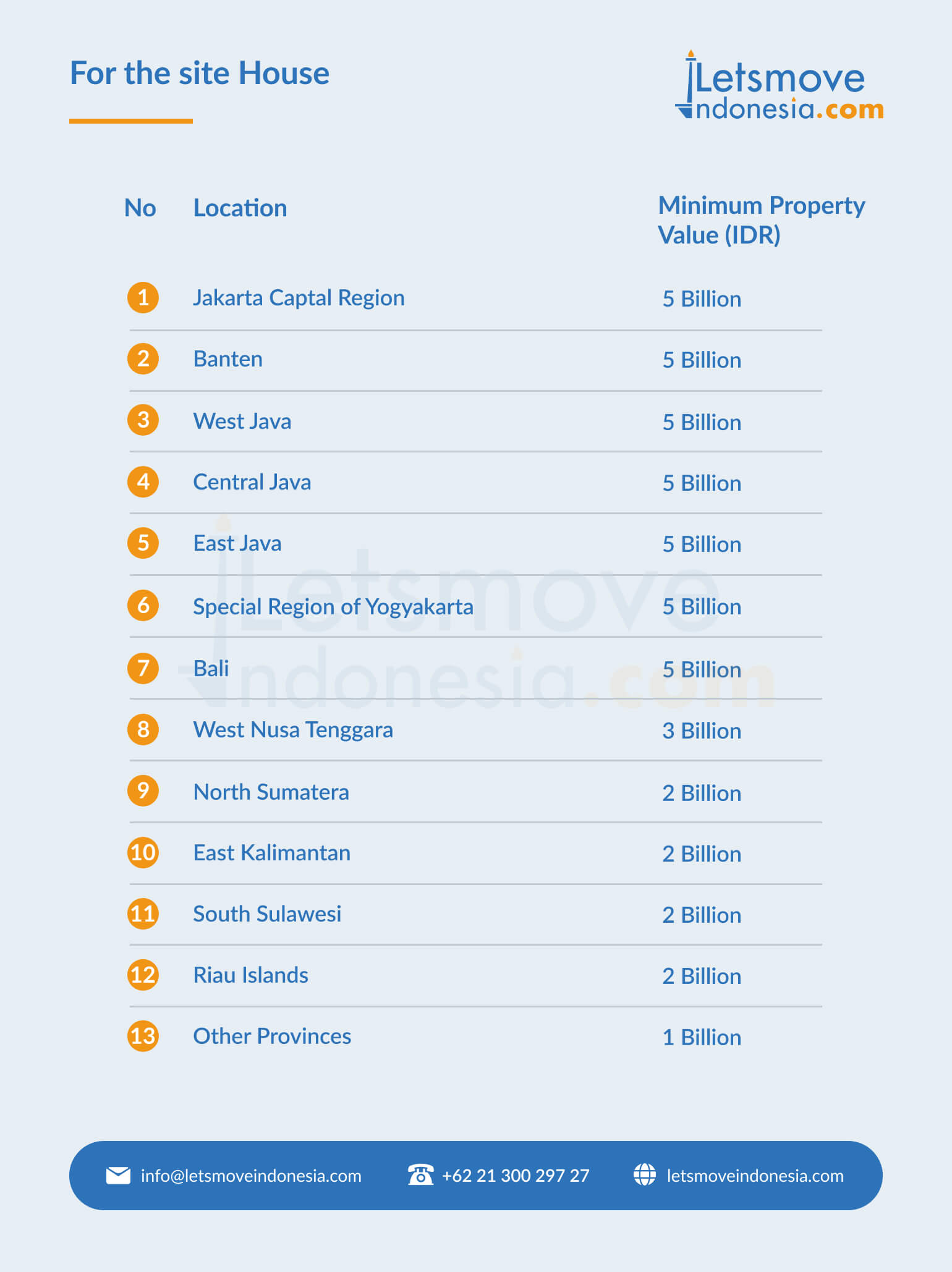

For foreigners who wish to buy a house in Indonesia, the government has set a price limit for houses and apartment that can be purchased by WNA based on the region, as shown in the following table:

For the site house:

For the apartments:

Lease Terms

The lease terms for “Hak Pakai” properties vary depending on the type of property:

- Single house on Hak Pakai land: 30 years, renewable for 20 years, and renewable for another 30 years.

- Single house on Hak Pakai land on Hak Milik land: 30 years, renewable for 20 years, and renewable for another 30 years (subject to agreement with the land title holder).

Getting a Mortgage for Foreigners

Buying a property in Indonesia as a foreigner can be a complicated process, especially when it comes to financing. This is where Lets Move Group can help.

Lets Move Group is a trusted property consulting company that specialises in helping foreigners buy property in Indonesia, including getting a mortgage. Our team of professionals will help you understand the mortgage process for foreigners, from the requirements and documents needed to negotiating with banks.

We will also help you choose the mortgage product that best suits your needs and financial capacity. With Lets Move Group, you can be confident that your mortgage application process will be smooth and efficient.

Find this article helpful? Check out our other articles from Social Expat for more Indonesia Guide!